Starting a new business is exciting, but the financial side can feel overwhelming if you do not set it up early. A clean bookkeeping system from day one saves time, protects cash flow, and makes tax and reporting simple instead of stressful.

This step by step guide walks you through a practical setup that works for most small businesses. You do not need to be an accountant, you just need a consistent structure you can maintain.

Step 1 Choose your bookkeeping method and tools

Begin by deciding whether you will use cash basis or accrual basis bookkeeping. Cash basis records income and expenses when money moves, while accrual records them when they are earned or incurred.

Most new small businesses start with cash basis because it is easier to track and matches the bank balance. If you invoice ahead, carry inventory, or need stronger reporting, accrual may be the better long term fit.

Next, pick software that suits your size and comfort level. Cloud tools like Xero, MYOB, or QuickBooks are popular because they automate bank feeds and keep records accessible anywhere.

If you want local help setting up the right platform and chart of accounts, a bookkeeping service Sunshine Coast can guide you to support options used by small businesses in the region. For more information you can click here.

Set up your chart of accounts before entering transactions. Keep categories simple and aligned with tax codes, such as income, cost of goods, rent, utilities, marketing, travel, wages, and assets.

A tidy chart prevents messy reports later and makes your accountant’s job cheaper at year end.

Step 2 Separate finances and build your recording routine

Open a dedicated business bank account and card, and stop mixing personal spending with business costs. This single move removes confusion and keeps your records defensible if you are ever audited.

Route every business payment and receipt through these accounts so your books mirror reality.

Create a simple document flow for receipts and invoices. Use a phone scan app or the software’s capture tool, then attach each receipt to the matching transaction.

Do this weekly so paperwork never piles up and you do not forget what a cost was for.

Decide how you will invoice and how you will track unpaid invoices. Number invoices consistently and record payments against them, so you always see who owes you and what is coming in soon.

Late payment reminders should be part of the process, not a last minute panic.

Step 3 Reconcile, review reports, and prepare for tax

Reconciliation is matching your bookkeeping records to your bank statements. Do it at least once a month, and weekly if you have many transactions.

This keeps errors small and prevents hidden problems like duplicated payments or missing income.

Once reconciliation is clean, review three core reports. The profit and loss tells you if you are making money, the balance sheet shows what you own and owe, and the cash flow statement shows timing health.

Reading these monthly helps you adjust spending and pricing before issues grow.

Set aside tax and GST as you go instead of waiting for the bill. Many businesses transfer a fixed percentage of each payment into a separate savings account.

This protects cash flow and stops tax time from becoming a crisis.

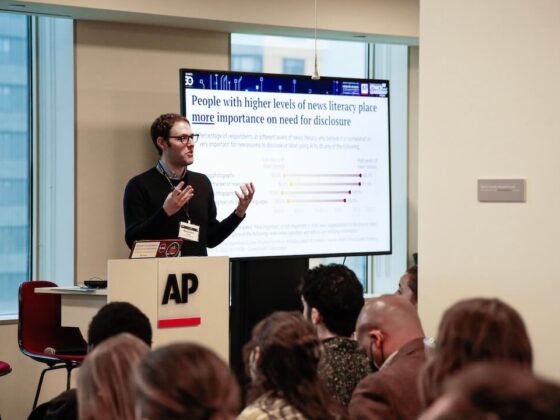

Schedule a quarterly check in with an accountant or advisor, even if it is brief. They can confirm your setup, flag compliance risks early, and make sure you are claiming everything you should.

Think of it as a tune up that keeps your bookkeeping aligned with growth.

Conclusion

A good bookkeeping setup is not complicated, it is consistent. Choose the right method and software, separate your finances, record transactions weekly, and reconcile and review reports on a routine.

With that structure in place, your new business starts with control, confidence, and far fewer financial surprises.